Check Fraud: How to Recognize It and Protect Your Money

Even in the digital age, checks remain a common way to pay bills, issue refunds, and move money. Unfortunately, they are also a popular target for fraud. Scammers use fake, stolen, or altered checks to deceive individuals and businesses, often causing serious financial damage before the fraud is even discovered.

At Michigan United Credit Union, we are committed to helping you understand how check fraud works and how you can stay one step ahead.

What Is Check Fraud

Check fraud occurs when someone manipulates or misuses a check to steal funds or personal information. This can involve counterfeit checks, stolen checks, altered checks, or fraudulent check deposits made through ATMs or mobile apps.

Some scams involve sending you a check and asking you to return a portion of the money. Others might involve someone accessing your checking account and forging checks in your name.

Common Types of Check Fraud

- Counterfeit Checks

Fake checks made to look like they come from a legitimate business or bank - Check Overpayment Scams

A scammer sends a check for more than the agreed amount and asks you to send back the difference - Stolen Checks

Thieves steal blank checks or checks from your mail and use them to withdraw funds - Altered Checks

A legitimate check is tampered with to change the payee name or the dollar amount

Mobile Deposit Fraud

Scammers deposit fake or stolen checks using a mobile banking app, then withdraw the funds quickly before the fraud is detected

Red Flags to Watch For

- Receiving a check from someone you do not know or were not expecting

- Being asked to send money back after depositing a check

- Urgent instructions to cash a check and forward funds

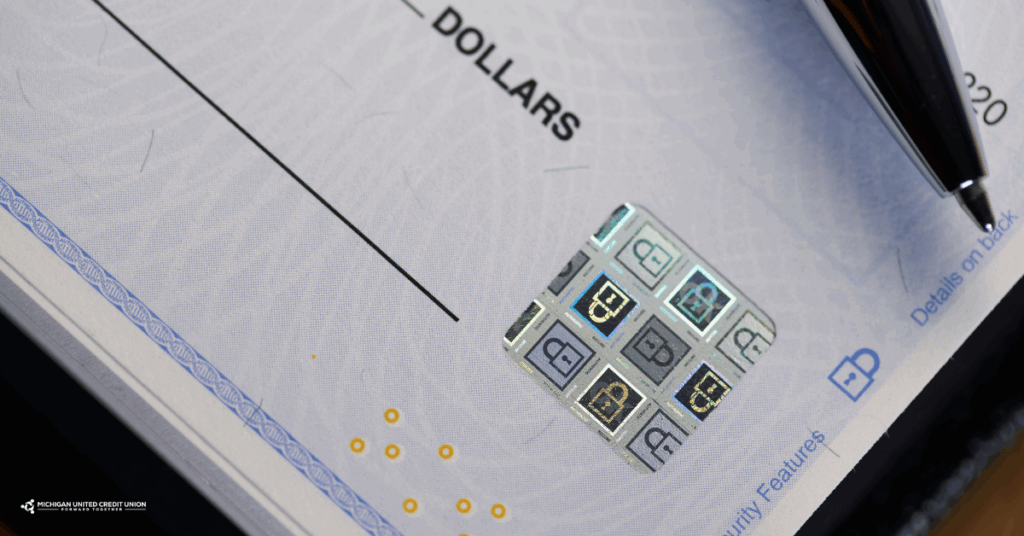

- Poor printing quality, suspicious bank names, or odd formatting

- Check amounts that do not match the agreed terms

- Requests to deposit checks and purchase gift cards or transfer money elsewhere

How to Protect Yourself

- Never deposit a check from someone you do not know or trust

- Do not agree to send money back to someone after receiving a check

- Confirm with your credit union that the check has fully cleared before using the funds

- Shred unused or voided checks and store your checkbook in a secure place

- Use secure mailboxes when sending or receiving checks

- Monitor your accounts frequently for unfamiliar activity

- Sign up for alerts through your Michigan United Credit Union account to catch fraud early

What To Do If You Suspect Check Fraud

If you believe you have received a fraudulent check or your account has been compromised:

- Contact Michigan United Credit Union immediately to freeze your account if necessary

- Do not cash or deposit the check

- Save all related communication, including texts or emails from the scammer

- Report the incident to the Federal Trade Commission at reportfraud.ftc.gov

- File a police report if checks were stolen or forged

- Monitor your credit report for unusual activity

We’re Here to Help

Check fraud can be financially and emotionally stressful, but you are never alone. Michigan United Credit Union is here to help you detect suspicious activity, secure your accounts, and recover if fraud does occur.

If you ever feel unsure about a check or a request involving your account, contact us first. A quick call can save you a lot of trouble.

If a check looks suspicious or comes with unusual instructions, trust your instincts. When in doubt, verify. Your financial safety is our priority and we are always here to help you stay informed, aware, and protected.