Bill Pay

Mobile Banking

Mobile Web Banking

You can log into It’sMe24/7 Online Banking from your mobile phone and you can securely access your account. View your account balances, and details for savings, checking, certificates, loans and credit cards. You can view the following information: funds on hold for savings and checking, pending authorization for credit cards, pending ACH transactions, transfer funds between accounts etc.

Mobile App

We are proud to introduce our new Michigan United Credit Union Mobile App which is available for both Apple and Android users. This app includes features such as Person-2-Person payment, Remote Deposit Capture, Card Control, and Biometrics security login features such as face recognition, fingerprint activation to access your account.

GO TO GOOGLE PLAY STORE

GO TO APP STORE

See/Jump Feature

The Jump feature is now enabled in the mobile app. Click here to learn more.

Mobile Check Deposit

Eligible members have the ability to take a picture of their checks and send in for deposit through the Michigan United Credit Union mobile app.

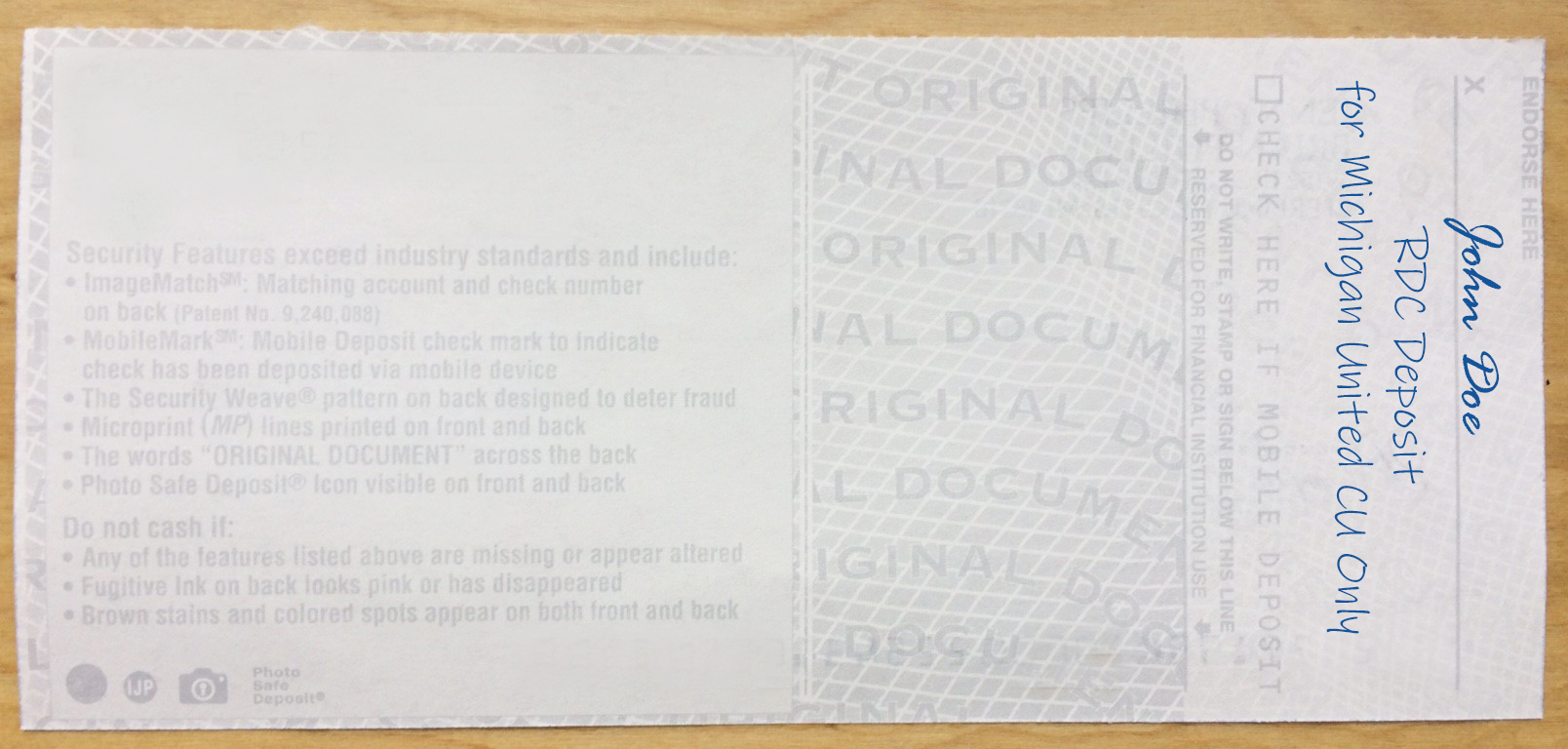

Tip 1 – Restrictive Endorsement: please sign the back of your check and underneath your signature please write “RDC Deposit for Michigan United CU only”. Please refer to the sample image below.

Tip 2 – Deposit by 11 PM ET and your money will generally be available for withdrawal by the next business day, subject to our hold policy. Daily deposit limit is $2,500.

Tip 3 – Write “Deposited” and today’s date on the front of your check. Hold onto the check for a week in case we need to review it.

Tip 4 – To avoid delays in processing or rejection of your check, please ensure that the quality of the image is clear and in focus.

Who is eligible for Mobile Deposit?

– A member who has opened/maintained active Michigan United Credit Union checking account and/or savings account for at least 90 days.

-A member in good standing.

-A member who is at least 14 years of age.

-A member with a credit score (if known) of at least 600.

-A member who has no NSF charges in the past 6 months.

Mobile Text Banking

Mobile Text Banking allows you to send a text message command to receive text message replies regarding the balance of your savings, checking, certificates, loans, and credit card accounts.

NOTE: Text banking is currently fee free, however your mobile phone carrier may charge you standard text messaging fees.

With Text Banking you can:

- -Send a text message command to receive text message replies regarding the balance of your eligible accounts.

- -Transfer funds between your own accounts using shortcut codes you configure.

- -Enroll in e-Alerts and receive notices regarding account balances, deposits, withdrawals, or when a payment is due.

Text Banking Commands

The following are Text Banking command examples and their responses. You can also access a list of these commands via a link in online banking during the Text Banking enrollment process. These commands can be sent to IM247 (46247).

| Commands | Descriptions |

|---|---|

| BAL | Balance for all eligible accounts |

| BAL BIZ | Balance for up to three savings or checking accounts (in this example “BIZ” is a nickname you set up for a membership, when you have more than one) |

| BAL 010 | Balance for a specific account suffix (010 in this sample) |

| BAL BIZ 010 | Balance for a specific membership and account combination (in this example “BIZ” is a nickname you set up for a membership, when you have more than one) |

| STOP | Turns off all text banking |

| STOP BIZ | Turns off text banking for a specific membership (in this example “BIZ” is a nickname you set up for a membership, when you have more than one) |

| TRANS MYCODE 100.00 | Transfers the specified amount ($100.00 in this sample) between sub-accounts (in this example “MYCODE” is a code you configured to represent both the “from” and “to” account suffixes) |

| TRANS MAIN MYCODE 100.00 | Transfers the specified amount ($100.00 in this sample) between sub-accounts (in this example “MYCODE” is a code you configured to represent both the “from” and “to” account suffixes) under a specific membership (in this sample “MAIN” is a nickname you set up for a membership, when you have more than one) |

| HELP | The customer service number |

eAlerts

– Notification of an ACH Deposit or Withdrawal

– Daily balance notification

– Daily notification showing total $ amount of transactions

– Daily notification showing total number of transactions

– Notification that a Loan Payment is due

– E-Notice notification

eStatements

Receive your monthly statement directly to your inbox. You can securely view your statement online, and reduce the amount of paper clutter in your home.

Check Reordering

Harland Clarke 1-800-858-3355 provides check order services to our members. Login using Michigan United Credit Union’s routing number 272477199 and your account number. NOTE: If your name or address has changed since your previous check order, please contact us at 248-814-4000.

To conveniently order your checks online from Harland Clarke, please visit Order My Checks

Now you can conveniently & securely send money from your account to individuals such as paying the babysitter, giving money to your grandchildren, or repaying a friend.

Person-to-Person (P2P) Payment allows you to securely send a payment via email or text message to an individual with an account with another financial institution.

You won’t need to know the recipient’s banking information (account #, etc.) and they won’t need to know yours!

What do I need to use P2P payment?

• You will need to have a Michigan United Credit Union Checking Account

• A valid email address

• Access to Online Banking

How to Enroll in P2P Payment:

• Log into your Online Banking account

• Select “Pay & Transfer”

• Select “Enroll in Pay Anyone”

• Enter the necessary information and select “Sign Me Up!”

How to Send Money:

• Select “Pay & Transfer”

• Select “Pay Anyone”

• Enter the recipient’s name, select either “Email” or “Mobile Phone” from the drop down menu. Enter the recipient’s email address or phone number.

• Enter the dollar amount and select the checking account.

• For security purposes, you need to enter a question with an answer. The recipient only receives the question via email or text so they need to enter the correct answer. Helpful Tip: Ask a question the recipient readily knows the answer, or send the answer in a separate text/email to the recipient.

NOTE: If the recipient does not collect the payment within 10 days, the payment is automatically cancelled and notifications will be sent.